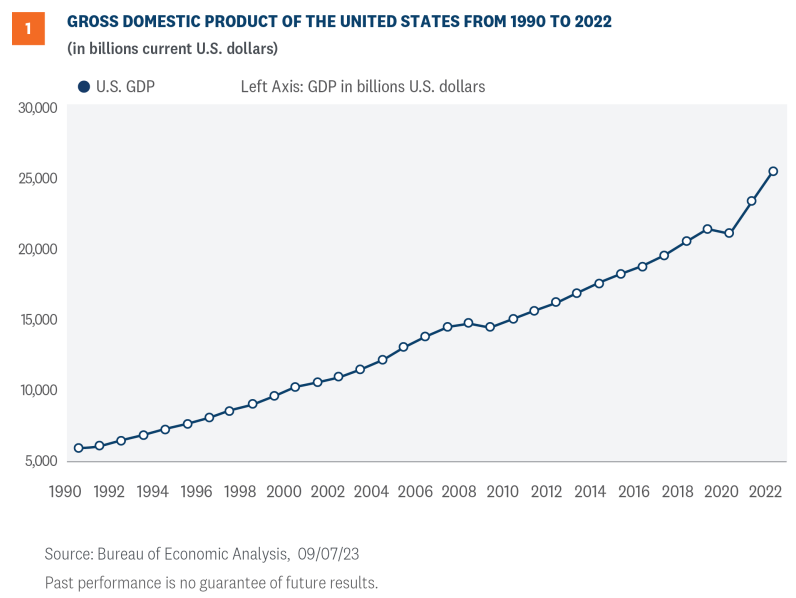

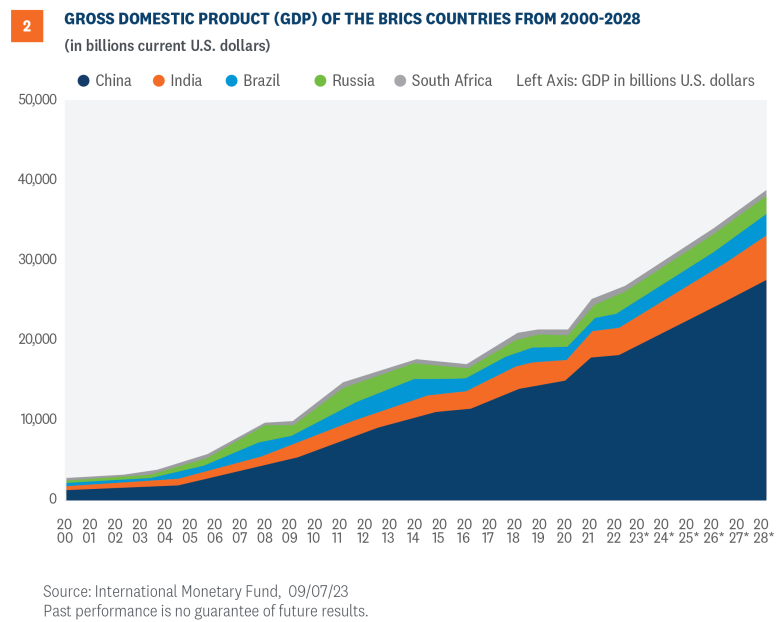

The BRIC acronym, without the “S,” was introduced in 2001 by the Goldman Sachs chief economist who highlighted the prodigious growth and investment prospects of Brazil, Russia, India, and China combined. In 2009, Russia advanced the BRIC platform to create an informal bloc that could challenge the dominance of Western nations, particularly the United States. In 2010, South Africa joined and became the “S” in the BRICS lexicon. The original bloc, an informal economic alliance, comprises approximately 45% of the global supply chain for commodities, including industrial, precious, and agricultural products. In terms of contribution to global GDP, the BRICS constitute 31%, with expectations for a more expanded share as the new BRICS+ entrants are installed in 2024. The bloc has been characterized as the “commodity powerhouse of the world,” and that title will only strengthen with additional members.

Interest in Emerging Markets Benefit the Brics

As emerging market investing became increasingly popularized, underpinned by the dramatic evolution and modernization of China, the BRICS remain a consistent theme, so much so that numerous countries have sought entry into the BRICS complex.

According to a press release leading up to the recent BRICS Summit 2023, there was a waiting list of 40 countries expressing interest in being admitted to the group, an indication of its growing attraction to non-Western nations, coupled with the allure of shifting the global economic—and political—dynamic. Moreover, official statements from BRICS leaders underscore that “This growing coalition is a testament to the increasing influence of BRICS in the international arena and its potential to shape the future of global finance.”

The fifteenth annual BRICS summit concluded in late August with an agreement to admit Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates (UAE), representing a veritable mix of the rich and poor within emerging markets, and with a markedly higher exposure to oil-rich nations.

The official communique from the summit heralded the group’s strength and underlined its mission for global peace in addition to announcing the 2024 entrants to BRICS+.

Although new members are seen as a significant win for BRICS, questions remain regarding the economic impact the new nations will have overall. Further doubts center on the geopolitical instability witnessed between the new member states. For example, Saudi Arabia and Iran remain de facto rivals in the Middle East, and Egypt and Ethiopia are still engaged in negotiating a diplomatic solution to sharing the great resources of the Nile. China and India remain in constant conflict over their shared border.

In terms of economic performance, Argentina is struggling with another heavy bout of inflation and is facing an election that could deliver the presidency to a libertarian candidate who wants to dissolve the central bank and dollarize the currency, despite the fact that dollarization is the antithesis of the BRICS anti-dollar goals. Russia remains under heavy sanctions and faces decreased investments from NATO members, which have taken a significant toll on its economy and currency. China’s economy is suffering from weak exports, tepid consumer spending, and a property market mired in debt. Problems are emerging as well within its shadow banking system, with some financial institutions halting monthly payments to customers. One of the most serious problems currently facing Beijing is rising youth unemployment, which according to official data, now represents approximately 21% of total unemployment.

The BRICS Platform Focused on Removing Dollar Hegemony

A recent article in the North Korean media summed up the most clarifying rationale underpinning the BRICS platform: “The unprecedented international moves to limit the use of the dollar and the tendency of many countries to join BRICS are accelerating the end of the dollar as a key currency and the end of the U.S. hegemonism pursuant to it.” With North Korean leader Kim Jong Un planning to meet with Vladimir Putin later this month to discuss an arms deal that would be designed to support Moscow’s war effort, there has been a steady stream of rumors suggesting that the secretive and closed North Korea may seek to broaden its trade relationships perhaps through a relationship with the BRICS. Clearly, North Korea enjoys solidarity with most of the BRICS in its singular effort to dismantle the dollar as the world’s reserve currency and the status associated with it.

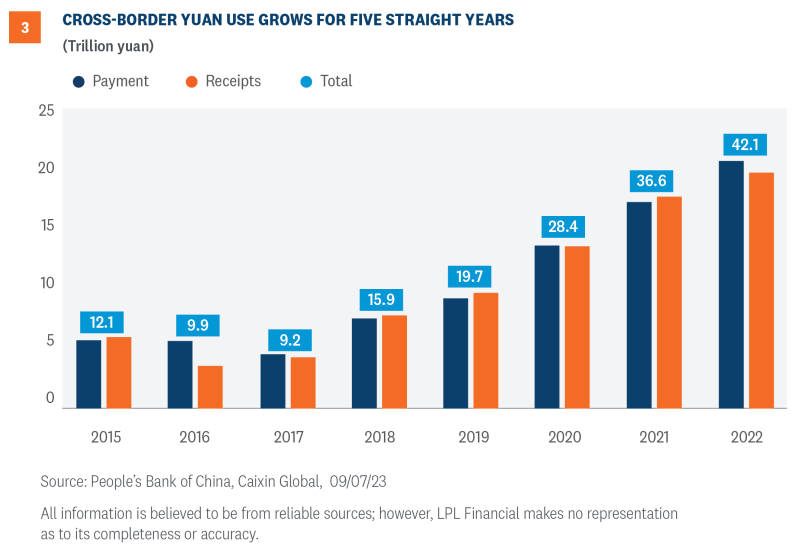

Luiz Inacio Lula da Silva, the leftist president of Brazil, addressed the forum with a call for members to construct a viable currency that can be used for trade and investments between the partnership, with the goal of “aiming to reduce the reliance on the U.S. dollar and promote the use of national currencies in international trade.”

The anti-dollar movement gained momentum as Russia and China, in orchestrated unison, began a campaign to accuse the U.S. of weaponizing the dollar and pointed to the multitude of sanctions imposed against Russian assets following Russia’s campaign against Ukraine.

The agenda for an international reserve currency has been discussed for decades, and at last year’s BRICS conference Putin announced that the bloc had begun working on creating a strong counterpart to the dollar. Analysts had speculated the new currency would be backed by gold, or a combination of gold and an additional commodity. There has been no further update on any concrete plans to introduce a new trading vehicle.

Still, the dollar remains the preferred currency in nearly all major global transactions. Based on 2022 data, the dollar is situated on one side of 88% of all foreign exchange trades, while 60% of all international deposits and loans hold the dollar. The dollar, in terms of central bank foreign exchange reserves, has eased since 1999 when it stood at just over 70%, to nearly 60% in 2022.

G-20 Meeting Highlights Internal BRICS Rivalries

With India hosting this year’s G-20 meeting, noticeably absent is China’s President Xi Jinping and Russia’s Vladimir Putin, two of the founding members of the BRICS. With Putin at war with Ukraine and the NATO coalition backing Ukraine, it wasn’t expected that he would participate in the G-20 gathering. Xi, however, has attended all of the meetings since 2013, when he became president. He’s forged a closer relationship with Russia, while China’s relationship with India has deteriorated as the Himalayan border dispute intensifies.

This political undercurrent has given Western leaders an opportunity to present their case to the nations attending, while India has emphasized that the G-20 platform should not reflect an anti Western bias. At the BRICS summit the prevailing theme centered on advancing the bloc as a major counterweight to the West and dismantling the dollar’s reserve currency status.

Emerging Markets is More Than Economics

What the BRICS+ offers is an opportunity within the broader emerging market composite, but given the political overhang on these markets, investing in this space has become more than just focusing on valuations, profits, and economics. Emerging market investing can be fraught with a litany of political and regulatory landmines that remind investors and traders alike why they are called emerging markets.

The BRICS+1 opportunity is vast, but so too are potential difficulties. Over the years, emerging markets (EM) as an asset class has proliferated and expanded, including frontier markets, however, the early homogeneity that defined EM has evolved towards a decidedly more heterogeneous EM.

Active management affords investors a more studied approach to benefit from what the BRICS+ community has to offer.

Investment Conclusion

BRIC+ offers opportunities but also carries significant risks. Slumping earnings and ongoing geopolitical uncertainty suggest caution, though valuations remain attractive and there are pockets of opportunities. For example, Latin America offers an opportunity for investors to take advantage of near-shoring trends, and India enjoys a promising long-term economic outlook. Active management can take advantage of these opportunities while limiting risk of further potential weakness in Chinese equities.

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) recommends a neutral tactical allocation to equities, with a modest overweight to fixed income funded from cash. The risk-reward trade-off between stocks and bonds looks relatively balanced to us, with core bonds providing a yield advantage over cash. A Fed pause has historically been a positive for core bond investors.

The STAAC recommends being neutral on style, favors developed international equities over emerging markets, large caps over small, and recommends overweight allocations to the energy and industrials sectors.

Within fixed income, the STAAC recommends an up-in-quality approach with benchmark-level interest rate sensitivity. We think core bond sectors (U.S. Treasuries, agency mortgage-backed securities (MBS), and short-maturity investment grade corporates) are currently more attractive than plus sectors (high-yield bonds and non-U.S. sectors), with the exception of preferred securities, which look attractive after having sold off due to stresses in the banking system.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk. Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. As interest rates rise, the price of the preferred falls (and vice versa). They may be subject to a call feature with changing interest rates or credit ratings.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-1627733-0823 | For Public Use | Tracking # 477057 (Exp. 09/24)